Our surveys also show that about 20 percent of the financial institutions studied use the highly centralized operating-model archetype, centralizing gen AI strategic steering, standard setting, and execution. About 30 percent use the centrally led, business unit–executed approach, centralizing decision making but delegating execution. Roughly 30 percent use the business unit–led, centrally supported approach, centralizing only standard setting and allowing each unit to set and execute its strategic priorities. The remaining institutions, approximately 20 percent, fall under the highly decentralized archetype.

Scaling gen AI in banking: Choosing the best operating model

It is important to research each option thoroughly and consider factors such as pricing, user reviews, and features to determine the best fit for your business. We answered some commonly asked questions about AI finance tools to help you discover the ideal software for your business. Ease of use was evaluated based on the software’s user interface, navigation, and overall user experience. Factors such as accessibility and intuitiveness were considered in determining the ease of use of each tool. In this AI finance software review, we’ll examine the top-rated AI finance tools, as well as what/who they are best for, their pros and cons, features, and pricing to help you discover the best solution for your business.

Best AI Finance Tools in 2024

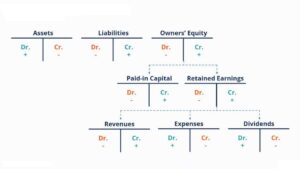

Under the General Data Protection Regulation, consumers have some protections from fully automated decision making, in which no humans are involved. While these skills are often necessary in the initial stages of the AI journey, starters and followers should take note of the skill shortages identified the differences between internal and external business balance sheets by frontrunners, which could help them prepare for expanding their own initiatives. Frontrunners surveyed highlighted a shortage of specialized skill sets required for building and rolling out AI implementations—namely, software developers and user experience designers (figure 13).

How is AI driving continuous innovation in finance?

The good news here is that more than half of each financial services respondent segment are already undertaking training for employees to use AI in their jobs. This portfolio approach likely enabled frontrunners to accelerate the development of AI solutions through options such as AI-as-a-service and automated machine learning. At the same time, through crowdsourced development communities, they were able to tap into a wider pool of talent from around the world. We recently conducted a review of gen AI use by 16 of the largest financial institutions across Europe and the United States, collectively representing nearly $26 trillion in assets. Our review showed that more than 50 percent of the businesses studied have adopted a more centrally led organization for gen AI, even in cases where their usual setup for data and analytics is relatively decentralized.

- This archetype has more integration between the business units and the gen AI team, reducing friction and easing support for enterprise-wide use of the technology.

- It is no surprise, then, that one in two respondents were looking to achieve cost savings or productivity gains from their AI investments.

- Financial advisors are preparing themselves for the largest transfer of wealth in U.S. history.

- They can use AI-driven insights to inform their company strategy and improve market predictions.

- Kavout uses machine learning and quantitative analysis to process huge sets of unstructured data and identify real-time patterns in financial markets.

Centralized steering allows enterprises to focus resources on a handful of use cases, rapidly moving through initial experimentation to tackle the harder challenges of putting use cases into production and scaling them. Financial institutions using more dispersed approaches, on the other hand, struggle to move use cases past the pilot stage. We have found that across industries, a high degree of centralization works best for gen AI operating models.

These are mainly large institutions whose business units can muster sufficient resources for an autonomous gen AI approach. We have observed that the majority of financial institutions making the most of gen AI are using a more centrally led operating model for the technology, even if other parts of the enterprise are more decentralized. Second, automated financial close processes enable companies to shift employee activity from manual collection, consolidation, and reporting of data to analysis, strategy, and action. Using our own solutions, Oracle closes its books faster than anyone in the S&P 500—just 10 days or roughly half of the time taken by our competitors. This leaves our financial team with more time focused on the future instead of just reporting the past. AI assistants, such as chatbots, use AI to generate personalized financial advice and natural language processing to provide instant, self-help customer service.

Finance professionals will still need to be proficient in the fundamentals of finance and accounting to oversee the algorithms and be able to spot anomalies. However, their day-to-day work will increasingly focus less on crunching the numbers and more on data interpretation, business analysis, and communication with key stakeholders. Skills, such as business strategy, leadership, risk management, negotiation, and data-based communication and storytelling, will help to complement the abilities of AI in finance. Specific software, such as enterprise resource planning (ERP,) is used by organizations to help them manage their accounting, procurement processes, projects, and more throughout the enterprise. Examples of back-office operations and functions managed by ERP include financials, procurement, accounting, supply chain management, risk management, analytics, and enterprise performance management (EPM).

Robotic process automation (RPA), cognitive automation, and artificial intelligence (AI) are transforming how financial services organizations operate. Today, many organizations are still in the early stages of incorporating robotics and cognitive automation (R&CA) into their businesses. AI’s data-crunching capabilities empower investors by providing comprehensive risk assessments based on historical data and market trends. This wealth of information equips financial advisors with insights crucial for informed investment decisions, fostering a more confident and aware investor community. Strengthening confidence and trust among financial advisors and clients will be especially important as economic conditions fluctuate.

Unlike rule-based automation, AI can handle more complex scenarios, including the complete automation of mundane, manual processes. Traditionally, financial processes, such as data entry, data collection, data verification, consolidation, and reporting, have depended heavily on manual effort. All of these manual activities tend to make the finance function costly, time-consuming, and slow to adapt. At the same time, many financial processes are consistent and well defined, making them ideal targets for automation with AI.

Among the data sets that their systems study are executives’ calls with analysts, in which they can scan for clarity of purpose, analyst responses, and whether companies’ results live up to what their bosses are saying. “We don’t allow any black box AI to be used near a decisioning process,” he says, referring to systems whose processes cannot be clearly explained. Here, AI systems are being used to look over documentation and speed up the assessment of whether a consumer can afford credit products, such as mortgages. User experience could help alleviate the “last mile” challenge of getting executives to take action based on the insights generated from AI.

For many IT departments, ERP systems have often meant large, costly, and time-consuming deployments that might require significant hardware or infrastructure investments. The advent of cloud computing and software-as-a-service (SaaS) deployments https://www.business-accounting.net/what-does-net-30-mean-in-finance/ are at the forefront of a change in the way businesses think about ERP. Moving ERP to the cloud allows businesses to simplify their technology requirements, have constant access to innovation, and see a faster return on their investment.

Canoe ensures that alternate investments data, like documents on venture capital, art and antiques, hedge funds and commodities, can be collected and extracted efficiently. The company’s platform uses natural language processing, machine learning and meta-data analysis to verify and categorize a customer’s alternate investment documentation. Quantitative trading is the process of using large data sets to identify patterns that can be used to make strategic trades. AI-powered computers can analyze large, complex data sets faster and more efficiently than humans.

This centralization is likely to be temporary, with the structure becoming more decentralized as use of the new technology matures. Eventually, businesses might find it beneficial to let individual functions prioritize gen AI activities according to their needs. A financial institution can draw insights from the details explored in this article, decide how much to centralize the various components of its gen AI operating model, and tailor its approach to its https://www.simple-accounting.org/ own structure and culture. An organization, for instance, could use a centralized approach for risk, technology architecture, and partnership choices, while going with a more federated design for strategic decision making and execution. High volume, mundane processes, such as invoice entry, can lead to fatigue, burnout, and error in humans. The end result is better data to work with and more time for the finance team to focus on putting that data to use.

Darktrace’s AI, machine learning platform analyzes network data and creates probability-based calculations, detecting suspicious activity before it can cause damage for some of the world’s largest financial firms. The platform validates customer identity with facial recognition, screens customers to ensure they are compliant with financial regulations and continuously assesses risk. Additionally, the platform analyzes the identity of existing customers through biometric authentication and monitoring transactions. Its offerings include checking and savings accounts, small business loans, student loan refinancing and credit score insights. For example, SoFi members looking for help can take advantage of 24/7 support from the company’s intelligent virtual assistant.

QuantumBlack, McKinsey’s AI arm, helps companies transform using the power of technology, technical expertise, and industry experts. With thousands of practitioners at QuantumBlack (data engineers, data scientists, product managers, designers, and software engineers) and McKinsey (industry and domain experts), we are working to solve the world’s most important AI challenges. QuantumBlack Labs is our center of technology development and client innovation, which has been driving cutting-edge advancements and developments in AI through locations across the globe.

Comments