All Form W-7 applications, including renewals, must include a U.S. federal tax return unless you meet an exception to the filing requirement. Those submitting ITIN applications need to demonstrate a federal tax reporting or filing requirement when submitting their W-7. All extensions for filing must include payment of the estimated tax owed. A non-citizen who has to file a federal tax return or a tax reporting document and does not qualify for an SSN should prepare an ITIN number application to get the ITIN number. If you need to renew your ITIN, you’ll follow the same process as applying for a new ITIN. However, if you mail in your renewal application, you can simply send along a form W-7 with supporting documents—no need to attach a tax return.

IRS ITIN Phone Number

No, you’re not legally allowed to apply for an ITIN if you have an SSN or are currently applying for an SSN. You need to apply for the ITIN together with your return and send it to the ITIN operations center. A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS.

What Addresses Must a Taxpayer Provide?

You should apply for ITIN number as soon as you can just so you have it done and out of the way. There isn’t a window in which you have to apply or a deadline you have to meet each year. IRS processes return showing SSNs or ITINs in the blanks where tax forms request SSNs. An ITIN makes it possible for an illegal immigrant to open a bank account within the United States as well. It also makes it possible for an illegal immigrant to apply for a mortgage loan. If you do not want to apply for a PTIN online, use Form W-12, IRS Paid Preparer Tax Identification Number Application.

Can I Apply For an ITIN if I Have an SSN?

You can apply for an ITIN without filing a tax return if you meet the criteria for one of the exemptions. To apply for ITIN for non-resident individuals, form W-7 is used to obtain an ITIN. In some cases, F1 visa individuals may be eligible to obtain an SSN, which would mean they don’t need an ITIN. This signature https://www.online-accounting.net/single-entry-bookkeeping-system/ requires you to either go somewhere in person to fill out the ITIN application or you have to wait for the application to be sent to you in the mail, fill it out, and send it back in. Depending on where you live and what type of mailing options you have, this is something that can take a while.

- With an ITIN number, you can also open a U.S. bank account and apply for a mortgage loan.

- Failure to respond to the IRS letter may result in a procedural assessment of tax by the IRS against the foreign entity.

- This is generally satisfied with a certified copy of your passport.

- Upwardli credit builder products are provided by Cross River Bank, Member FDIC.

This number is merely used as a label so the federal government can identify you and allow you to file taxes. This number serves no https://www.accountingcoaching.online/ other purposes and can’t be used for much else. Technically, your Individual Tax Identification Number is pretty similar to an SSN.

It is important to advise taxpayers about potential consequences. The IRS Disclosure Statute (I.R.C § 6103 (c) et al.) prohibits the sharing of information but has many exceptions. The other big mistake is when people forget to sign the ITIN application and it has to come back just for the signature. The time it takes for the application to go between you and the IRS is the biggest reason why individuals are encouraged to apply for this number before tax season. Your Individual Tax Identification Number is a tax identification number used by the IRS. It makes it possible for someone who can’t get an SSN to still file taxes.

Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in the ITIN Documentation Frequently Asked Questions, before requesting an ITIN. These criteria can be difficult to meet and advocates are working to clarify the requirements of the letter from a doctor. ITINs should not be given to employers when they receive no-match letters from the SSA (see below for more information on no-match letters) because it is not an SSN. Under limited circumstances, such as a case settlement context, an employee might want to consider giving his employer his ITIN for use in issuing a W-2. However, it is still unclear what the SSA does when they receive W-2s with an ITIN.

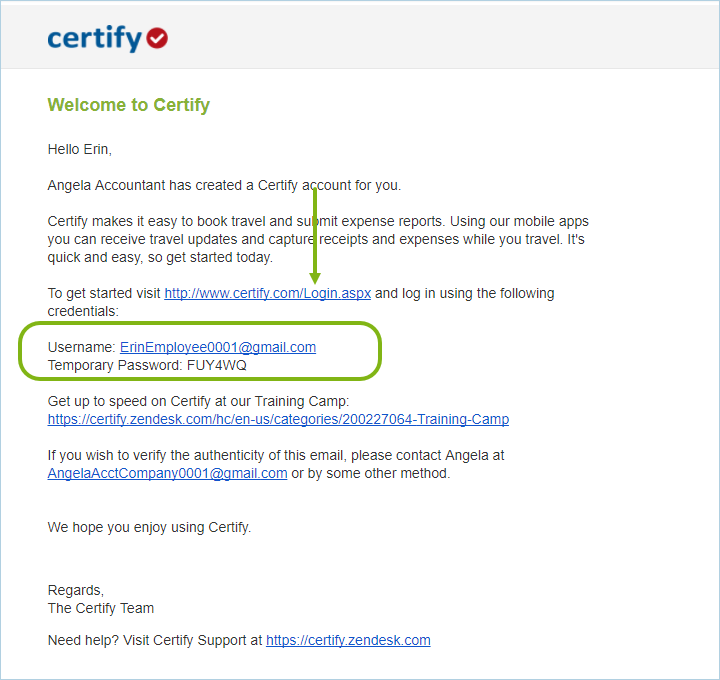

They’ll review the W-7 and documentation before sending it to the IRS. To obtain an ITIN, you must complete IRS Form W-7, IRS Application for Individual Taxpayer Identification Number. The Form W-7 requires documentation substantiating foreign/alien status and true identity for each individual. Form W-7(SP), Solicitud de Número de Identificación Personal del Contribuyente del Servicio de Impuestos Internos is available for use by Spanish speakers. An adoption taxpayer identification number, or ATIN, is a temporary, nine-digit tax ID number the IRS gives to people who are in the process of adopting a child. The IRS provides the number if the adopting parents cannot get a Social Security number for the child in time to file their tax return.

Original documents you submit will be returned to you at the mailing address shown on your Form W-7. Applicants are permitted to include a prepaid Express Mail or courier envelope for faster return delivery of their documents. The IRS will then return the documents in the envelope provided by the applicant. IRS issues ITINs to foreign nationals and others who have federal tax reporting or filing requirements and do not qualify for SSNs. A non-resident alien individual not eligible for an SSN who is required to file a U.S. tax return only to claim a refund of tax under the provisions of a U.S. tax treaty needs an ITIN. ITINs are issued regardless of immigration status because both resident and non-resident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

The SSA has a large earnings “suspense fund” for all the monies paid that cannot be accounted for under assigned SSNs. I provide these services for many what are prepaid expenses clients, and I’m happy to help you. This gives you plenty of time to deal with any problems and receive your ITIN number before tax season arrives.

Comments